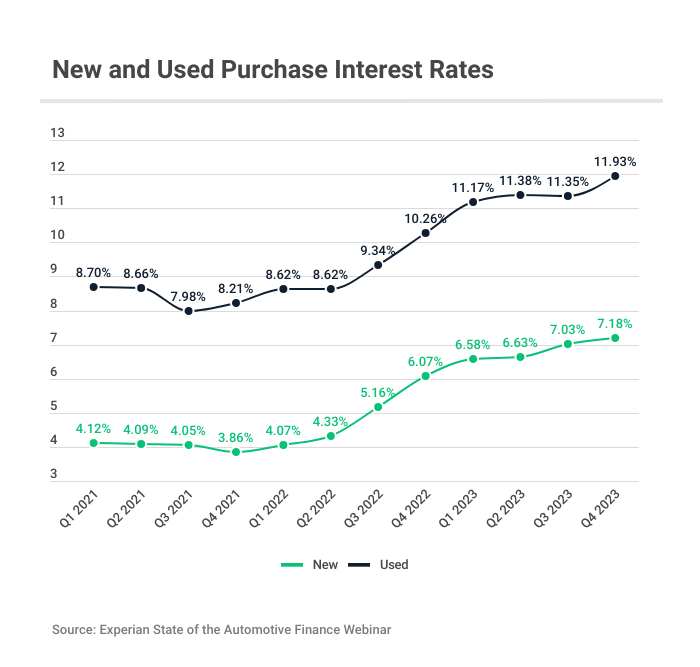

Since the first quarter of 2022, average auto financing rates have surged dramatically. For new vehicles, rates went from 4.07% in early 2022 to 7.18% at the end of 2023 — a 76% increase. During that same timeframe, rates for used car loans soared 38%, from 8.62% to 11.93%.

Auto loan rate insights for 2024

Insights from Jacob Channel, LendingTree Senior Economist

| What might happen to auto loan rates in 2024? | What kind of car prices can buyers expect in 2024? |

“Auto loan rates may come down as 2024 progresses, but significant declines aren't guaranteed. Fortunately, regardless of what the Fed does, shopping around for an auto lender can still help those in the market for a car save money.

Different lenders can offer different rates to the exact same borrowers. Shopping around can help you lower your monthly payments and save money over the lifetime of your loan.” | “As pandemic-era supply chain issues continue to subside, and inventory rises, car prices have fallen, and they may continue to tick down as 2024 progresses.

That said, prices are unlikely to plummet, and depending on what you're planning to buy, you could still end up spending a pretty penny on a new or used vehicle.” |

Tips to get a better auto financing rate

Improving your credit score isn’t the only way to get a better car loan rate. You could also:

Order your credit report

Order your free credit report and check for errors. Disputing credit report errors can give your score a lift. Unfortunately, errors are more common than you might think.

Make a down payment

Not all auto loans require a down payment. Even so, it may be a good idea to make one anyway.

Putting money down takes some of the lender’s risk and transfers it to you. After all, you’ll lose your down payment if the lender repossesses your car. As a result, a down payment can help you secure a better rate.

Consider a shorter loan term

Cars are getting more expensive, so 84-month car loans are increasingly popular. That’s because longer terms usually mean lower monthly payments. However, longer terms also almost always carry higher rates.

Shop during a promotional event

Captive financing is when you get your car loan straight from your car’s manufacturer. Occasionally, these manufacturers offer 0% APR car deals (usually around holidays and the end of the year). There’s a caveat, though — these deals typically only apply to specific vehicles.