An auto loan is a type of loan typically secured by collateral — the vehicle you purchase — though some lenders offer unsecured auto loans. Auto loans can be used to buy a new car, refinance a current loan, buyout a lease or purchase recreational and powersport vehicles.

Auto loan lenders typically have repayment terms ranging from 36 to 84 months, though some may offer shorter or longer term limits. Keep in mind that if you default on your loan, your lender may repossess your car and your credit score will suffer.

How do auto loans work?

With an auto loan, you agree to repay a lender over a set term, typically three to six years, in exchange for them paying a dealership (or a private seller) so that you can get a car. By paying interest, your total cost of borrowing is higher than the purchase price of your car, which equates to profit for the lender. How much more you pay in interest will largely depend on your credit score.

Interest rate or APR

The interest rate on an auto loan is the percentage of the loan amount that you pay to the lender each year. It is the cost of borrowing money. The APR, or annual percentage rate, is also a percentage, but it includes the interest rate as well as other fees associated with the loan, such as origination fees and prepayment penalties. The APR is a better measure of the true cost of borrowing money than the interest rate alone, because it takes into account all of the fees that you will pay.

Auto loan rates trends: How to get a more favorable interest rate.

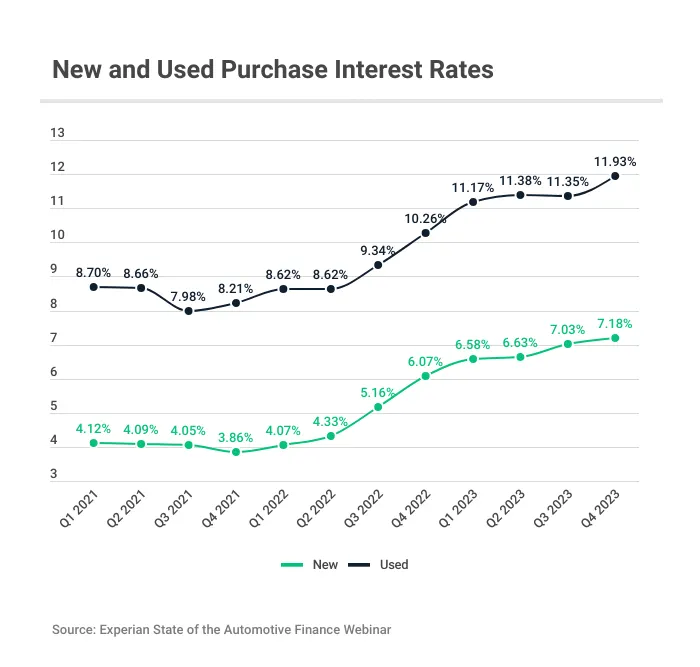

Since the first quarter of 2022, auto loan rates have surged dramatically. For new vehicles, rates have skyrocketed by 76%, soaring from 4.07% in early 2022 to 7.18% at the end of 2023. Similarly, the rates for used auto loans have surged by 38%, jumping from 8.62% in early 2022 to a hefty 11.93% by the end of 2023, as per Experian data.

To get the best auto loan rates:

- Check your credit score: Lenders typically offer better rates to borrowers with higher credit scores. If you have a low score, consider taking some time to improve your credit score to qualify for more favorable rates.

- Shop and compare: Using LendingTree’s auto loan marketplace, you can compare rates for up to five lenders at a time with just a few clicks (and no impact to your credit).

- Consider shorter loan terms: Short-term car loans typically are rewarded with a lower interest rate.

- Make a larger down payment: If you have the ability to, make a larger down payment as this can help you get a lower car loan rate.